Maximize Your Financial Savings With a Federal Cooperative Credit Union

Discovering the world of Federal Cooperative credit union for maximizing your cost savings can be a tactical monetary action worth thinking about. The advantages, varying from higher rate of interest to tailored cost savings alternatives, provide a compelling opportunity to boost your economic wellness. By comprehending the advantages and choices offered, you can make enlightened decisions that align with your cost savings objectives. So, allow's explore the nuances of maximizing your cost savings potential with the distinct offerings of a Federal Credit Union and how it can lead the way for a much more secure monetary future.

Benefits of Federal Cooperative Credit Union

An additional trick benefit of Federal Cooperative credit union is their focus on financial education. They often give sources, workshops, and customized assistance to help participants enhance their economic proficiency and make audio money monitoring decisions. This dedication to empowering members with monetary expertise sets Federal Credit report Unions aside from other banks. In Addition, Federal Lending institution are insured by the National Lending Institution Management (NCUA), providing a comparable level of security for deposits as the Federal Deposit Insurance Corporation (FDIC) does for banks. Overall, the benefits of Federal Credit score Unions make them an engaging selection for people wanting to maximize their cost savings while receiving personalized service and assistance.

Membership Eligibility Standards

Membership eligibility criteria for Federal Credit report Unions are established to manage the qualifications individuals should meet to enter. These criteria ensure that the lending institution's subscription remains exclusive to individuals that satisfy specific needs. While eligibility criteria can vary slightly in between various Federal Debt Unions, there are some typical aspects that candidates might experience. One normal criteria is based upon the individual's location, where some cooperative credit union serve certain geographic locations such as a certain community, employer, or association. This aids develop a sense of area within the lending institution's subscription base. In addition, some Federal Cooperative credit union might need individuals to come from a certain occupation or sector to be eligible for subscription. Family relationships, such as being a family member of an existing participant, can additionally often act as a basis for subscription qualification. Comprehending and satisfying these criteria is vital for people seeking to sign up with a Federal Debt Union and capitalize on the economic advantages they provide.

Savings Account Options Available

After establishing your eligibility for subscription at a Federal Debt Union, it is crucial to check out the various cost savings account choices available to optimize your monetary benefits. Federal Credit rating Unions normally use a range of savings accounts tailored to fulfill the varied demands of their participants.

An additional preferred selection is a High-Yield Interest-bearing Accounts, which uses a higher rate of interest compared to normal cost savings accounts. This kind of account is excellent for participants wanting to gain a lot more on their savings while still keeping adaptability in accessing their funds. Additionally, some Federal Cooperative credit union offer customized interest-bearing accounts for certain financial savings objectives such as education, emergency situations, or retirement.

Tips for Saving A Lot More With a Credit History Union

Wanting to enhance your savings prospective with a Federal Debt Union? Below are some tips to assist you save better with a debt union:

- Make The Most Of Greater Passion Prices: Federal Credit score Unions commonly offer greater rates of interest on financial savings accounts compared to conventional financial institutions. By transferring your funds in a cooperative credit union financial savings account, you can make even more rate of interest with time, helping your savings expand quicker.

- Explore Different Cost Savings Products: Cooperative credit union offer a range of financial savings products such as certificates of deposit (CDs), cash market accounts, and private retirement accounts (IRAs) Each item has its own benefits and functions, so it's vital to check out all options to find the most effective suitable for your savings objectives.

- Establish Automatic Transfers: Schedule computerized transfers from your monitoring account to your lending institution cost savings account. This method, you can continually add to your financial savings without needing to believe concerning it on a regular basis.

Comparing Debt Union Vs. Conventional Bank

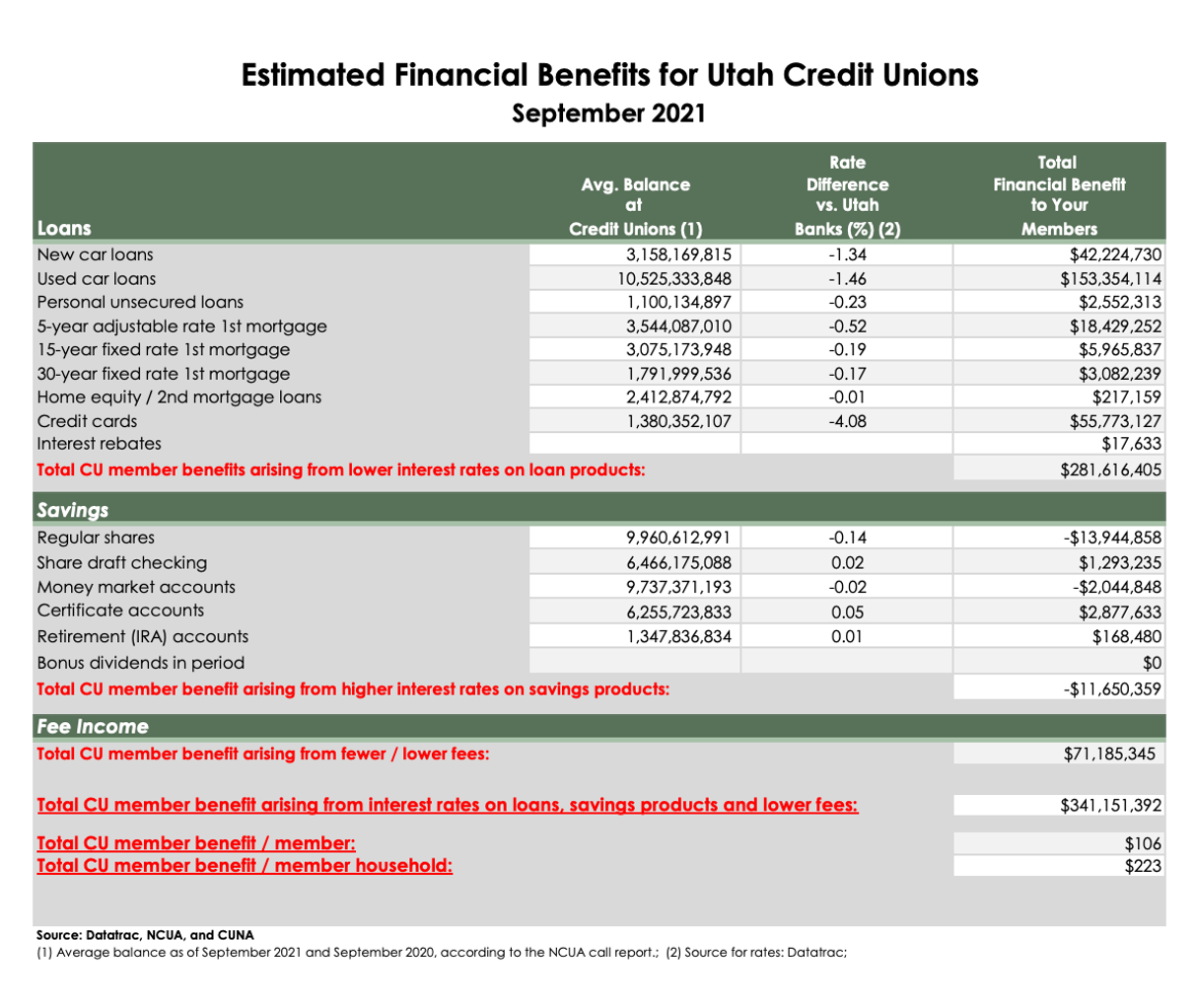

When assessing banks, it is very important to take into consideration the distinctions between cooperative credit union and typical banks. Cooperative credit union are not-for-profit companies had by go to this site their participants, while standard banks are for-profit entities possessed by shareholders. This essential distinction frequently translates right into better rates of interest on financial savings accounts, lower lending prices, and less fees at lending institution compared to banks.

Cooperative credit union typically use an extra personalized approach to financial, with a concentrate on community involvement and participant satisfaction. In contrast, conventional banks might have a much more considerable series of solutions and places, yet they can in some cases be perceived as less customer-centric because of their profit-oriented nature.

An additional trick distinction remains in the decision-making procedure. Lending institution are regulated by a volunteer board of directors elected by members, guaranteeing that choices are made with the very best rate of interests of the members in mind (Cheyenne Federal Credit Union). Typical financial institutions, on the various other hand, operate under the direction of paid Get More Information execs and investors, which can occasionally bring about choices that prioritize earnings over customer benefits

Eventually, the selection between a lending institution and a standard bank depends on specific choices, financial objectives, and banking requirements.

Verdict

In final thought, making the most of savings with a Federal Cooperative credit union supplies countless benefits such as higher interest rates, lower financing rates, decreased costs, and extraordinary customer support. By making use of various financial savings account options and checking out different financial savings items, people can customize their cost savings technique to meet their financial objectives effectively. Picking a Federal Credit Rating Union over a standard financial link institution can lead to greater financial savings and monetary success over time.

Federal Credit report Unions are guaranteed by the National Credit History Union Management (NCUA), giving a comparable degree of protection for down payments as the Federal Deposit Insurance Policy Firm (FDIC) does for financial institutions. Credit Unions Cheyenne.After identifying your qualification for subscription at a Federal Debt Union, it is important to check out the numerous savings account choices available to optimize your monetary benefits. Furthermore, some Federal Credit Unions supply specific financial savings accounts for details cost savings goals such as education and learning, emergency situations, or retired life

By transferring your funds in a credit score union cost savings account, you can earn more passion over time, aiding your cost savings expand faster.

Explore Different Cost Savings Products: Credit score unions offer a selection of financial savings products such as certifications of deposit (CDs), cash market accounts, and individual retired life accounts (IRAs)